nCa Report and Commentary

The Malaysian multinational Petronas has been developing the block 1 of the Caspian sector of Turkmenistan under a production sharing agreement (PSA) since 1996. The arrangement underwent major transformation and expansion, both in scale and scope, on 14 May 2025.

High power delegations of Abu Dhabi and Petronas were in Ashgabat on 14 May 2025 to sign some landmark agreements with Turkmenistan.

Of the two major agreements signed during the multilateral interaction, one pertains to the inclusion of the ADNOC-XRG and Turkmenneft as partners in the PSA: Petronas 57%, XRG 38%, and Hazarnebit (a subsidiary of Turkmenneft) 5%.

This configuration upgrades the PSA to consortium where XRG is an investment partner.

The other major document is the long-term Gas Sales Agreement (GSA) the PSA partners have signed with State Concern Turkmengaz.

The arrangements will reportedly cover a period of 25 years and will include the joint development of some new fields in addition to the PSA territory.

The current production of gas from this PSA is 400 million cubic feet per day which comes to about 4.134 billion cubic meters (bcm) per annum. These are rather conservative estimates. The actual production could be in the vicinity of 5 bcm.

The PSA territory is estimated to hold 7 trillion cubic feet of gas which amounts to nearly 200 bcm.

In this report, we will first reproduce the Petronas press release giving the essential details of the arrangements. After that, we will give an overview of the Petronas presence in Turkmenistan. Further, we will give the introductory information about XRG and some of its investment activities so far. In doing so, we want to underline that XRG was launched less than 6 months ago and its operations started from the first quarter of this year.

This report also gives the composition of the delegations of ADNOC and Petronas, to highlight the importance accorded by the participants to the cooperation agreements signed in Ashgabat.

In our own commentary near the end of this report, we will underline the significance of these agreement and some other aspects.

Petraons Press Release

Ashgabat, 14 May 2025 –PETRONAS, XRG, State Enterprise Hazarnebit, and State Concern Turkmennebit have signed a new Production Sharing Contract (PSC) for the Block I gas and condensate fields in Turkmenistan. As part of the transaction, a long-term Gas Sales Agreement (GSA) was also signed with State Concern Turkmengas.

Under the terms of the PSC, PETRONAS will hold 57% participating interest as the operator, partnering with XRG (38%), with State Enterprise Hazarnebit holding the remaining 5%.

Located in the Caspian Sea, the Block I concession currently produces approximately 400 million cubic feet of natural gas per day. It offers significant long-term potential, with access to over 7 trillion cubic feet of natural gas resources and future opportunities for production capacity expansion. The collaboration supports Turkmenistan’s efforts to ensure energy supply stability and export diversification while delivering sustainable growth and economic value to all parties, amid rising regional and global demand for natural gas.

PETRONAS Executive Vice President and Chief Executive Officer of Upstream, Mohd Jukris Abdul Wahab said, “As the first international operator in Turkmenistan’s energy sector close to three decades ago, this milestone reinforces our presence and signifies our continued expansion in the Upstream sector. We are privileged to contribute to the ongoing advancement of the nation’s energy industry and remain committed to fostering long-term partnerships with XRG, Hazarnebit, Turkmennebit and Turkmengas.” he added.

XRG President, International Gas, Mohamed Al Aryani stated, “This agreement marks an important milestone in XRG’s global growth strategy and builds on the strengthening relationship between the UAE and Turkmenistan. It strengthens XRG’s presence in the Caspian region, expands our resource base, and reflects our ambition to be a reliable supplier of cleaner energy to meet the world’s evolving needs. By deepening our partnership with PETRONAS, Turkmennebit, and Turkmengas, we are advancing energy security and economic development, while creating long-term value for all stakeholders.”

PETRONAS has been in Turkmenistan since 1996 and is currently the operator for Block 1 and the Gas Treatment Plant and Onshore Gas Terminal (GTPOGT) in Kiyanly. [Petronas]

Overview – Petronas in Turkmenistan

(From Linkedin)

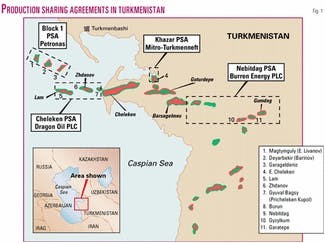

PETRONAS Carigali (Turkmenistan) Sdn Bhd was founded circa 1996 after PETRONAS has been awarded with Block 1 waters, Turkmenistan. In July 1996, Petronas and the government of Turkmenistan signed a 25-year Production Sharing Agreement for the exploration, development and production of offshore Block 1, including the Garagel-Deniz (Gubkin), Deyarbekir (Barinov) and Magtymguly (East Livanov) fields.[i] Block 1 is located approximately 80 km southwest of Turkmenbashi.[ii] This was the first PSA to be awarded by the government of Turkmenistan. That same year, the government of Turkmenistan announced that Petronas planned to invest more than $210 million in its operations. By 2002, Petronas had successfully drilled and tested four wells, indicating vast oil and gas reserves at a high rate of flow.

In October 2003, Petronas signed a Memorandum of Understanding with Dragon Oil to explore possible areas for collaboration, including “gas development, transmission, marketing and sales of gas, drilling services, and field operations and logistics.”

In June 2006, “KazTransGas, which is part of Kazakhstan’s national oil and gas company KazMunayGas and Turkmenistan-based PETRONAS Charigali Sdn.Bhd, a subsidiary of Malaysian PETRONAS Carigali Overseas Sdn. Bhd,…signed a memorandum of understanding on natural gas transportation from Turkmenistan using Kazakhstan’s pipeline network”. A press release from KazTransGas stated that “the aim of the memorandum is to determine the definition of the areas and terms of cooperation between the countries in the transportation of natural gas from the future Beregovoi onshore terminal in Turkmenistan via Kazakhstan’s operating pipelines MG Okarem-Beineu and MG SAZ-3.

ADNOC LAUNCHES XRG: AN $80+ BILLION LOWER-CARBON ENERGY AND CHEMICALS INVESTMENT POWERHOUSE

XRG will initially focus on transformational global investments that create value across natural gas, chemicals, and lower-carbon energy solutions

Strategy to meet rising global demand for lower-carbon energy and chemicals required to power sustainable economic growth

XRG aims to capitalize on three megatrends: transformation of energy, exponential growth of AI, and the rise of emerging economies. [from ADNOC website]

Investment decisions by XRG so far

Since its launch in November 2024, ADNOC’s international investment arm, XRG, has made several notable investment decisions, focusing on its strategic platforms of global chemicals, international gas, and low-carbon energies. Below is a summary of the investment decisions and projects based on available information, with a focus on confirmed actions post-launch:

Investment Decisions and Projects (November 2024 – May 2025)

Acquisition of Covestro (German Chemicals Producer)

Details: XRG became the majority shareholder of Covestro, a German chemicals and plastics manufacturer, through a $16.3 billion takeover. By December 2024, XRG secured 91.3% of Covestro’s outstanding shares, marking its first major transformational investment in chemicals. The deal aims to position XRG as a top-five global chemicals player, capitalizing on a projected 70% increase in global chemical demand by 2050.

Status: The takeover exceeded the minimum acceptance threshold by November 27, 2024, with final results announced by December 19, 2024, after an additional acceptance period.

Source🙁https://www.agbi.com/petrochemicals/2024/12/adnocs-xrg-to-takeover-germanys-covestro/) (https://www.adnoc.ae/en/news-and-media/press-releases/2024/adnoc-launches-xrg) (https://www.rigzone.com/news/adnoc_forms_80b_investment_firm_to_grow_gas_chemicals_lowcarbon_assets-28-nov-2024-178877-article/)

Stake in Turkmenistan’s Block I Offshore Gas Field

Details: In May 2025, XRG secured a 38% stake in Turkmenistan’s Block I offshore gas and condensate field in the Caspian Sea, partnering with Petronas (Malaysia) and Hazarnebit. The field produces 400 million cubic feet per day and holds over 7 trillion cubic feet in reserves. This investment expands XRG’s international gas portfolio, aligning with its goal to meet a 15% increase in global natural gas demand over the next decade and a 65% rise in LNG demand by 2050.

Status: Announced and confirmed in May 2025, marking XRG’s entry into Turkmenistan’s upstream sector.

Source: (https://x.com/OilandEnergy/status/1922690414487740799) (https://x.com/ReutersCommods/status/1922640336439943454) (https://x.com/TheNationalNews/status/1922678499547959668)

Creation of Arcius Energy (Joint Venture with BP)

Details: In December 2024, XRG announced the formation of Arcius Energy, a joint venture with BP, focusing on upstream exploration activities, particularly in Egypt’s Eastern Mediterranean basin and underexplored offshore fields. Potential targets include fields like Atoll (North Damietta concession) and Zohr, where BP holds interests. This venture supports XRG’s international gas platform.

Status: Announced in December 2024, with operations expected to commence in 2025.

Transfer of U.S. Assets (Hydrogen and LNG Projects)

Details: In February 2025, ADNOC transferred its U.S. investments to XRG, including a 35% stake in ExxonMobil’s proposed hydrogen project in Baytown, Texas, and a 12% stake in NextDecade’s Rio Grande LNG export facility in Texas. These investments align with XRG’s low-carbon energies and international gas platforms, targeting growing demand for low-carbon ammonia (projected to reach 70–90 million tonnes annually by 2040) and LNG.

Status: Confirmed by ADNOC CEO Sultan Al Jaber in February 2025, with assets formally moved to XRG.

Source: (https://www.offshore-technology.com/news/adnoc-us-assets-investment-company/) (https://www.ainvest.com/news/adnoc-investments-chapter-xrg-2502/)

Potential Acquisition of Nova Chemicals (Under Discussion)

Details: ADNOC, through XRG, is in discussions with Abu Dhabi’s Mubadala Investment to acquire Nova Chemicals, a Canadian company with two U.S. facilities. This move would further bolster XRG’s global chemicals platform.

Status: Discussions were ongoing as of February 2025, but no final agreement has been confirmed.

Source: (https://www.offshore-technology.com/news/adnoc-us-assets-investment-company/)

Petrochemical Business Merger (Borouge and Borealis)

Details: In March 2025, XRG facilitated a deal with Austria’s OMV to merge their petrochemical businesses, Borouge and Borealis, into Borouge Group International, with a $60 billion enterprise value. The merged entity is set to acquire Nova Chemicals (owned by Mubadala), positioning it as the fourth-largest polyolefins firm globally by production capacity. This supports XRG’s ambition to dominate the global chemicals market.

Status: Announced in March 2025, with the merger and acquisition in progress.

Source: (https://www.reuters.com/business/energy/adnoc-eyes-international-listing-xrg-sources-say-2025-03-07/)

Summary of Investment Decisions

Total Investment Decisions: At least 6 confirmed or initiated investment decisions since November 2024, including acquisitions, joint ventures, asset transfers, and mergers.

Breakdown by Platform:

Global Chemicals: Covestro acquisition, Nova Chemicals discussions, Borouge-Borealis merger (3 decisions).

International Gas: Turkmenistan Block I stake, Arcius Energy joint venture (2 decisions).

Low-Carbon Energies: U.S. hydrogen and LNG asset transfers (1 decision, covering two projects).

Geographic Scope: Investments span Germany, Turkmenistan, Egypt, the United States, and Canada, reflecting XRG’s global focus.

Financial Commitment: The Covestro deal alone is valued at $16.3 billion, with the Borouge-Borealis merger at $60 billion enterprise value. XRG’s total asset value is over $80 billion, with a goal to double by 2035.

Composition of Petronas and ADNOC delegations

Petronas

- Tan Sri Tengku Muhammad Taufik – Petronas President

- M Jukris B Abdul Wahab – EVO & CEO Upstream

- Mohd Redhani B Abdul Rahman – Vice President International Assets

- Azahari Bin Mohd Shuid – SGM Strategy and Commercial

- Ahmad Shamsul Kamal B Zakaria – Senior Manager C&BD (International)

- Nurul Atyqah Bt Anis – Senior Manager C&BD (MEA)

- Mohd Faisal B Shafie – Senior Legal Consult (ME & Central Asia)

- Nurul Nadia Bt Rahmat – Manager (Commercial Finance)

- Nina Arutyunova (General Manager (C&BD – MEA)

- Timur Klychev – Manager (C&BD – APAC)

- M Johan Ariff Supian – Head, Executive Assistant

- Elinor Bt Bahrom – Head, Executive Assistant

- Mohammad Muzammil B Othman – EVP Executive Assistant

- Amiruddin B Jamil – VPIA Executive Assistant

- Yusmarinor Bt Yum – Manager Stakeholders Management USC

ADNOC

- Dr. Sultan Al Jaber – UAE Minister of Industry and Advanced Technology, Managing Director and Group CEO of ADNOC, Executive Chairman of XRG

- Suhail Al Mazrouei – UAE Minister of Energy and Infrastructure

- Ahmed Al Sayegh – Minister of State, UAE MOFA

- Dr. Mohammad Al Ariqi – UAE Presidential Affairs

- Mohammad Al Kaabi – Senior Vice President, International Strategic Relations Management and Government Affairs, ADNOC

- Hamad Al Marzooqi – Vice President, MD and GCEO Office, ADNOC

- Talal Al Fulaiti – Director of Minister’s Office, Ministry of Energy and Infrastructure

- Mohamed Al Aryani – President, International Gas, XRG

- Zayed Al Shayea – Manager, Government and Executive Affairs (Dr. sultan Al Jaber Office)

- Abdulla Al Shamsi – Director Business Development, XRG

- James Calderwood – Principal, Corporate Communications, XRG

- Valentina Vigoli – Business Development Manager, XRG

- Fares Alblooshi – Business Development Manager, XRG

- Andre Dauwalder – Senior Legal Counsel, XRG

- Bogdan Artemov – Junior Associate, Ashurst LLC

nCa Commentary by Tariq Saeedi

There is the obvious, and then there is the beyond the obvious.

The obvious:

There are ample hydrocarbon reserves in Block 1 and adjoining areas to justify 25 years of commitment.

There is strong viability to attract the fast moving investment engine XRG to the deal.

There is vast goodwill on all sides to make this deal a reality.

Since any other block was not mentioned during the press conference, we assume that the nearly 200 bcm of gas is possibly available at Block 1 and the adjoining fields that would be developed jointly. Therefore, we will call it Block 1 Plus tentatively.

What lies beyond the obvious is enormous and mostly still unquantifiable.

It is clear that the Block 1 Plus twin deal (quadrilateral PSA and development commitment, and tripartite gas purchase agreement) is a result of the roadshows and investment forums Turkmenistan has been hosting here and abroad.

It is also clear the investment climate of Turkmenistan is attractive to convince a global investment engine like XRG to join the PSA within the first quarter of its operations.

The partnership between Petronas, XRG, and Turkmenistan establishes a strong base for future cooperation in not only the upstream and downstream hydrocarbon sectors but virtually in any other area. We can say this with confidence because there is healthy and vigorous mutual respect and mutual trust in this relationship.

The reason why we are sure that the partnership will expand, sooner than later, to areas other than hydrocarbons is that all the partners in this equation – Turkmenistan, Petronas, XRG – accord great importance to the human dimension.

Also, diversification is a necessary part of expansion for any company of the stature of Petronas and ADNOC.

For instance, even though Petronas is strong in its core activity – upstream and downstream hydrocarbon sector – there is already the urge to expand into the adjacent areas.

Petronas Gas is exploring renewable energies.

Through MISC Berhad, Petronas is involved in shipping, offshore floating facilities, and logistics services for oil and gas.

Petronas markets lubricants and automotive fluids globally under brands like Petronas Syntium.

Petronas invests in R&D, digital transformation, and technology ventures, including partnerships in AI and carbon capture.

It operates service stations and convenience stores under the Petronas brand.

Similarly, ADNOC is not confined to the upstream and downstream hydrocarbon sectors only.

ADNOC is investing in renewable energy and decarbonization technologies. It holds a 24% stake in Masdar, a UAE clean energy company aiming for 100 gigawatts of renewable energy capacity by 2030. ADNOC has committed $15 billion by 2027 to lower-carbon projects, including green hydrogen (targeting 1 million tonnes by 2030) and carbon capture and storage.

Through subsidiaries like ADNOC Logistics & Services (formerly ADNATCO and NGSCO), ADNOC operates in crude oil and LNG shipping, delivering energy products to over 100 customers in 50 countries. It manages a 1,600km pipeline network for refined products.

ADNOC Distribution handles storage, transportation, and distribution of refined products, operating fuel retail stations in the UAE and Saudi Arabia.

It uses AI for innovations like fuel demand prediction.

ADNOC supports the expansion of Al Ruwais Industrial City, enabling growth in chemicals, manufacturing, and industrial sectors. This aligns with the UAE’s industrial development goals.

ADNOC’s Panorama Digital Command Centre, powered by AVEVA, integrates Industrial IoT, AI, and big data to optimize operations, saving $60M–$100M annually. AI tools also support carbon capture and fuel demand forecasting.

ADNOC is a major producer of granulated sulfur, accounting for 5% of global production as of 2021, primarily from its Shah Gas Field operations.

What we are trying to highlight is that the deals signed on 14 May 2025 are just the start of a journey that is destined to go places, beyond the obvious. /// nCa, 15 May 2025