Stefan Vuza, Chairman of Chimcomplex, Romania’s leading producer and supplier of vital chemicals since 1954, has outlined a strategic vision to accelerate investments in the chemical industry, with a particular focus on Turkmenistan. He made a presentation at the International Forum to Attract Foreign Investment in Turkmenistan’s Economy, TEIF 2025 in Kuala Lumpur.

This initiative includes the establishment of the Turkmen-Romanian Chemical Company (C.T.R.C.), a joint venture between Chimcomplex and Turkmenhimiya, aimed at fostering industrial development and economic collaboration.

The partnership will drive four key projects to enhance chemical production capabilities in Turkmenistan:

- Chlorosodium Factory with a capacity of 100,000 tons.

- Polyol Factory with a capacity of 40,000 tons.

- PVC Factory with a capacity of 140,000 tons.

- Production plants for various chemicals, including hypochlorite, acetylene, epsomite, sulfuric acid, sulfates, iodine, methanol, and potassium fertilizers.

To ensure energy efficiency and sustainability, the joint venture will also construct two cogeneration plants with capacities of 7.5 MW and 15 MW. These plants will supply critical electricity and steam to power the chemical installations, optimizing operational costs.

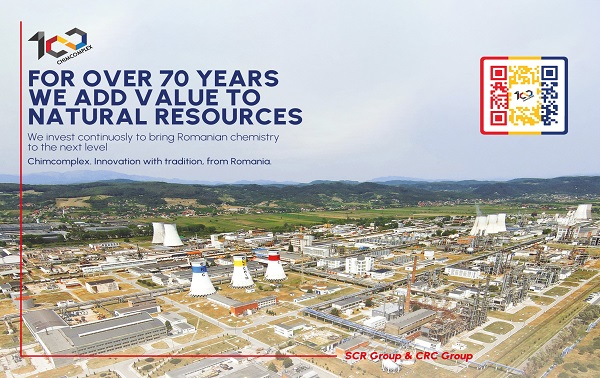

Chimcomplex, a public-private partnership with the Romanian Government as a key shareholder, has been a cornerstone of Romania’s chemical industry for over seven decades. The company specializes in producing a wide range of products, including polyether polyols, chlor alkali, and oxo-alcohols, which are integral to various industrial processes. Its expertise and strategic collaboration with the government position it as an ideal partner for international ventures like the C.T.R.C.

Why Invest in Turkmenistan?

Stefan Vuza strongly encourages investors to seize the opportunities in Turkmenistan’s chemical industry. The combination of abundant resources, supportive economic policies, and strategic location makes Turkmenistan a prime destination for growth and profitability. By investing in this dynamic market, stakeholders can contribute to the economic development and prosperity of both Turkmenistan and their home nations.

According to him, Turkmenistan presents a compelling case for investment in the chemical industry due to its unique advantages:

- Vast Resources: Turkmenistan has vast reserves of gas and salt, which result in competitive prices for raw materials used in chemical manufacturing.

- Investment policy: The country offers strategic economic policies for foreign investors, like tax exemptions, reduced tariffs, and streamlined regulatory processes, significantly enhancing the investment climate

- Strategic location: Turkmenistan has a strategic location and infrastructure that provide a strong foundation for industrial development. The country operates two refineries that supply complementary raw materials at competitive prices.

- Diversification: Investing in the chemical industry supports the diversification of export markets. Turkmenistan’s strategy is to transform its gas resources into value-added chemical products, opening new markets and enhancing economic stability.

- Turkmenistan has competitive energy prices^ The low cost of gas and electricity is a significant advantage for energy-intensive manufacturing industries, ensuring cost-effective operations.

- Guarantees: Investments in Turkmenistan have financial and guarantee support by European Co-Guarantee Institutions, such as the European Bank for Reconstruction and Development (EBRD), reducing financial risks and enhancing investor confidence. ///nCa, 23 April 2025