This is Part Three of the chapter on Turkmenistan of the recently issued CAREC Energy Outlook 2030 report.

The complete report is available at this link: https://www.adb.org/sites/default/files/publication/850111/carec-energy-outlook-2030.pdf

Energy Consumption

In 2018, energy intensity in Turkmenistan was 19.03 British thermal units (Btu) per dollar of GDP, which is nearly 4 times higher than the global average. In terms of industrial consumption, the main consumers of energy are the oil and gas industry, chemical industry, light industry, machine-building, and metal processing. However, actions have been taken to ensure further energy savings in the industrial sector.

For several years, the country has been introducing modern energy-saving technologies that meet international standards, including metering systems and natural gas meters at industrial enterprises.

As for energy consumption in the residential sector, Turkmenistan adopted new building codes in 2020.

The Ministry of Construction and Architecture of Turkmenistan is working, in partnership with the United Nations Development Programme (UNDP), to update legal and regulatory mechanisms for implementing energy conservation measures in residential building design and construction. However, regulations on the rules and procedures for energy audits of residential buildings in Turkmenistan are still under consideration.

Turkmenistan’s transportation fleet includes older vehicles that contribute to an increased carbon footprint. To counter this development, the importation of cars that are over 10 years old has been banned since 2011. Moreover, the import of passenger cars with engine volumes larger than 3.5 liters has also been prohibited since 2011. There are currently no charging stations for electric vehicles in Turkmenistan. The state plans to develop the local production of electric vehicles and to begin rolling out electric vehicle charging stations.

Regulatory Framework

Turkmenistan has recently been making progress in the development of its primary energy legislation, with the most active period being the 2010s. The Law on Electricity has been a stepping stone in establishing an overarching framework for the regulation of the country’s electricity generation (Government of Turkmenistan 2019a). It appointed the Cabinet of Ministers and the Ministry of Energy as the electricity sector’s two main regulators. Moreover, financial incentives for energy efficiency projects were introduced, and accelerating the deployment of renewable energy was set as an objective. In addition, the Law on Licensing, which determines the process for obtaining licenses across all sectors of the economy, including in the energy sector, has been approved (Government of Turkmenistan 2019b). The state remains a dominant player in the electricity market, in which generation, distribution, and transmission services are controlled by Turkmenenergo.

Recognizing the country’s renewable energy potential as well as the need to transition to more sustainable methods of energy generation, the government recently adopted the Law on Renewable Energy Sources (AzerNews 2021; Government of Turkmenistan 2021). The law established several key focus areas, including ensuring environmental and energy supply protection by introducing renewable energy sources (thereby, diversifying energy generation methods), as well as major incentives for renewable energy projects (including easier land leases, and guaranteed purchase of electricity generated from renewable sources). In 2021, the government adopted the Law on Public–Private Partnership that regulates the process of preparing and implementing public–private partnership projects.

Turkmenistan is making a sizeable commitment to achieve climate neutrality. The government adopted the National Strategy on Climate Change and the National Strategy for the Development of Renewable Energy until 2030 (Academy of Sciences of Turkmenistan 2021; UNDP 2012). The country actively participated in the 26th session of the Conference of the Parties to the United Nations Framework Convention on Climate Change (UNFCCC) in Glasgow in 2021. Turkmenistan has expressed interest in studying the Global Methane Commitment in detail with a view to possible participation. The country aims to achieve zero growth of greenhouse gas (GHG) emissions starting in 2030, and significant reductions of emissions in the longer term. The nationally determined contribution (NDC) of Turkmenistan is a confirmation of the country’s commitment to reduce GHG emissions by 2030 in key sectors of the economy.

Fossil fuel production in the country is mainly governed by the Law on Subsoil and the Law on Hydrocarbon Resources, which establish licensing rights (Government of Turkmenistan 2020). The State Agency for the Management and Use of Hydrocarbon Resources was abolished in 2016. Turkmengaz and Turkmenoil are legal successors of the State Agency for the Management and Use of Hydrocarbon Resources. Natural gas markets are dominated by Turkmengaz, which acts as the country’s primary developer, supplier, and seller of natural gas. Regarding the investment framework, Turkmenistan has two separate laws on investment (the Law on Investment Activities in Turkmenistan and the Law on Foreign Investments), both of which establish the main rights and duties of investors (Government of Turkmenistan 1992, 2008).

Policy Framework

During the past several decades, a variety of legal and regulatory acts have been issued in Turkmenistan’s energy sector. In recent years, the government launched initiatives to transition to a greener economy to tackle climate change. Several documents have been issued, including the National Program on Energy Conservation for 2018–2024, the National Program of Turkmenistan on Climate Change, and the Concept of Development of Energy Sector of Turkmenistan for 2013–2020. The most recent one, the National Strategy on Development of Renewable Energy in Turkmenistan for the period up to 2030, was issued in 2020 (Academy of Sciences of Turkmenistan 2021). It outlines the advantages of renewable energy for the country’s future economic development, and for the transition to a “greener” economy. The main targets of these policies are outlined below:

(i) Development of energy sector infrastructure. The country is increasing its efforts to rehabilitate existing energy infrastructure, commission new energy infrastructure, ensure the future security of supply, and increase its export capabilities.

(ii) Expansion of export capabilities. The government plans to expand the country’s export capabilities by increasing its efforts to establish regional interconnections, including Central Asia–PRC (line D), and others.

(iii) Focus on energy efficiency. Recognizing its rapid socioeconomic development and the need to decrease its energy intensity, the country plans to introduce practices that promote energy efficiency. In 2021, the government worked on developing a new Law on Energy Efficiency and Energy Saving, which the Parliament of Turkmenistan is currently considering (AzerNews 2021).

(iv) Transfer to renewable energy sources. Understanding the crucial need to reduce the energy sector’s carbon footprint, the country aims to transfer to “greener” methods of energy generation by harnessing the significant potential of its renewable energy sources (around 666 GW). As an initial step, the government, together with international financial institutions (IFIs), has recently developed the National Strategy on Development of Renewable Energy in Turkmenistan for the period up to 2030, and is expected to continue to develop regulatory documents that will complement and enable the implementation of the strategy. As of 2021, the government is working on a total of four legal acts. There are also plans to develop seven more legal acts that will facilitate renewables in Turkmenistan.

Forecast Methodology

One of the objectives of this country study is to present a detailed overview and analysis of Turkmenistan’s energy market trends. For this purpose, three scenarios were developed that take into account the country’s regulatory framework, technological development, consumer references, and other factors (Box 23).

Supply and demand, technology, carbon emissions, and investment outlooks were derived based on these scenarios.

Supply and Demand Outlook

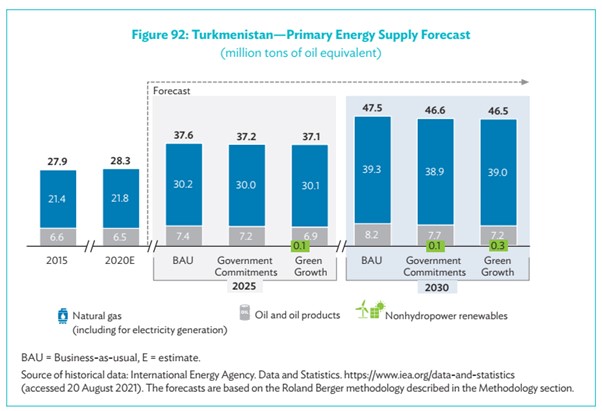

Turkmenistan’s energy sector has been significantly impacted by the COVID-19 pandemic. Decreased export volumes, economic uncertainty, and restrictions preventing the spread of the virus led to a nearly 5% decrease in energy demand in 2020. However, the demand is expected to rebound and to surpass prepandemic levels in 2022. Further growth of energy supply is foreseen in all three scenarios because of the expected economic growth until 2030. The Government Commitments scenario projects an annual growth rate for primary energy supply of 5.2% between 2020 and 2030, reaching almost 46.6 million toe by 2030. The Business-as-usual (BAU) scenario forecasts a higher growth rate for primary energy supply, reaching 47.5 million toe with a compound annual growth rate of 5.3% in 2030, as this scenario assumes energy efficiency measures will be limited. The Green Growth scenario, on the other hand, assumes a more intensive roll-out of energy efficiency measures and foresees a 5.1% annual growth rate for primary energy supply (the lowest of the three scenarios)—reaching almost 46.5 million toe in 2030. The differences in energy supply volumes across scenarios are insignificant, as natural gas is expected to remain the main source of primary energy supply.

Natural gas is Turkmenistan’s main source of primary energy supply, considering its sole dominance of the power generation mix. All three scenarios project that it will remain in this position until 2030, with the Government Commitments and Green Growth scenarios also projecting an increase in nonhydropower renewables (Figure 92).

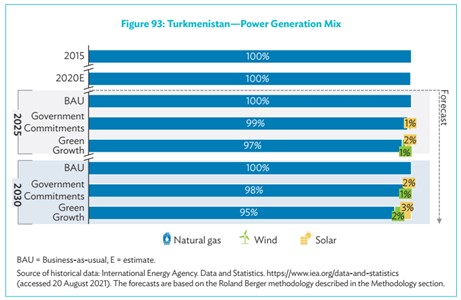

While making use of its abundant reserves of natural gas benefits the country’s security of supply, the government has recognized the environmental impact of natural gas power plants and has committed to introducing more renewable energy sources to the generation mix and to modernizing existing infrastructure. The key factor differentiating the three scenarios is the extent to which new renewable energy projects are developed in the country. For instance, the Government Commitments scenario projects the roll-out of solar power plants (accounting for 2% of the electricity mix) and wind power plants (1%). The BAU scenario, on the other hand, projects no change, based on historical development trends. In contrast, the transition to more sustainable methods of energy generation is most rapid under the Green Growth scenario, which projects that the share of solar power in the generation mix will reach 3% and wind power 2% (Figure 93).

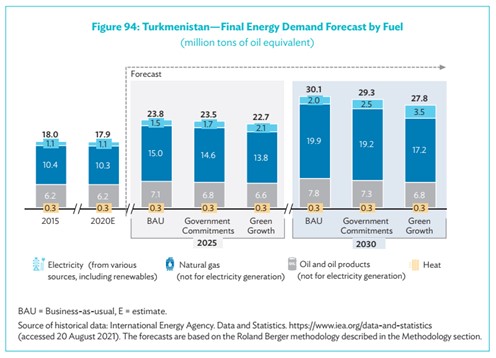

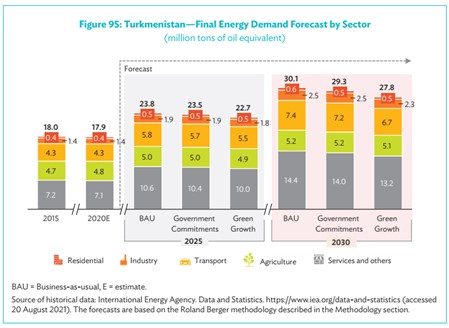

In 2030, total final energy demand is forecasted to be between 27.8 million toe and 30.1 million toe, depending on the different energy efficiency improvements projected by the three scenarios (Figure 94).

Electricity shows the highest growth, reflecting the growth of the economy and the market; according to Oxford Economics, real GDP is expected to grow nearly 7% per annum until 2030. This is closely followed by natural gas, which has varying growth among the scenarios, based on the extent to which energy efficiency measures are implemented. Oil consumption shows growth in all scenarios until 2030, from 6.8 million toe to 7.8 million toe.

The rapid economic development of the country has impacted the services sector most significantly.

It is projected to grow at a rate of 5.6%–6.5% annually, depending on the scenario (Figure 95). Transport and industry are also growing at a similar pace, with the industry sector projected to grow at a rate of 4.7%–5.6% annually, and transport at 4.0%–4.9%. /// nCa, 19 January 2023

To be continued . . .

Turkmenistan Energy Outlook 2030 – Chapter from CAREC Report – Part Two